On the other hand, OnDeck commonly presents higher desire costs than competition. Also, you’ll need to be prepared to make each day or weekly payments.

For those who’re working with the online lender, you’ll commonly find a way to accomplish the applying system promptly. These firms typically ask for essential information about your business and a few supporting paperwork.

Financial institution of The usa’s secured line of credit comes with a large minimum borrowing amount and inexpensive fascination price for very well-skilled borrowers. As well as, it provides a good amount of possibilities to gain price reductions.

After you’ve established the sort of collateral you’re likely to use, you’ll need to evaluate its benefit. Though your lender could request a different valuation, doing your own private evaluation in advance can assist you better recognize your likely borrowing electric power.

You might need to offer individual or business assets to secure a single of these online loans. iBusiness Funding can situation money in as little as two days.

Accounts receivable factoring. Accounts receivable factoring is often a sort of funding by which you offer your organization’s unpaid invoices to a factoring organization. Such a financing generally is a good choice for borrowers with poor or limited credit histories.

A secured business loan involves you To place up collateral, for instance real estate property or equipment to back again the loan. If you fail to repay a secured loan or line of credit, the lender has the best to seize your belongings for a sort of repayment.

But this compensation isn't going to impact the information we publish, or perhaps the opinions that you choose to see on This website. We do not include things like the universe of businesses or financial presents Which may be accessible to you.

You’ll want to check premiums and phrases on several loan gives to locate the greatest pne for the business. Can I have a startup business line of credit?

Collateral is often an asset the lender can seize should you default to the loan. For small businesses, property like equipment, funds financial savings or real-estate can typically function collateral for secured business loans.

Influence on your credit might range, as credit scores are independently how to get approved for a business line of credit based on credit bureaus based upon many components such as the monetary selections you make with other fiscal providers organizations.

Greater adaptability: Delivering cash or property property can usually open the door to much more finance selections.

copyright’s secured phrase loan features aggressive curiosity rates and extensive repayment phrases. It gives you the option to secure your loan employing business assets or certificates of deposit.

Auto loans guideBest auto loans forever and bad creditBest auto loans refinance loansBest lease buyout loans

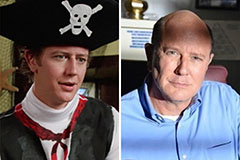

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Judge Reinhold Then & Now!

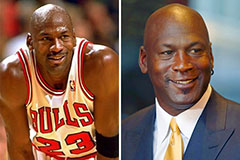

Judge Reinhold Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!